Running a business is as much about foresight and discipline as it is about innovation and opportunity. Yet too often, owners are caught off guard by financial challenges that could have been anticipated and managed. At Strategic Specialists, we see three themes arise time and again: the discipline of budgeting and forecasting, the importance of resourcing strategically, and the ever-present challenge of cash flow

Budgeting and Forecasting: Beyond the Guesswork

As the end of the financial year approaches, many leaders ask: “Where will this year land?” and “What can I expect from the next one?”

The biggest trap? Setting a revenue-only target. Revenue growth doesn’t guarantee profitability. In fact, I’ve worked with businesses that missed revenue goals yet strengthened their balance sheet and overall value through smart management of assets and working capital.

The key is breaking down budgets into realistic, phased milestones quarterly, monthly, even weekly. Factor in seasonality, lead times for sales, and the impact of new hires. And most importantly, delegate responsibility: when sales, procurement, operations, and back-office teams all own their part of the profit and loss, the whole business moves towards its targets.

Resourcing: The Right People in the Right Seats

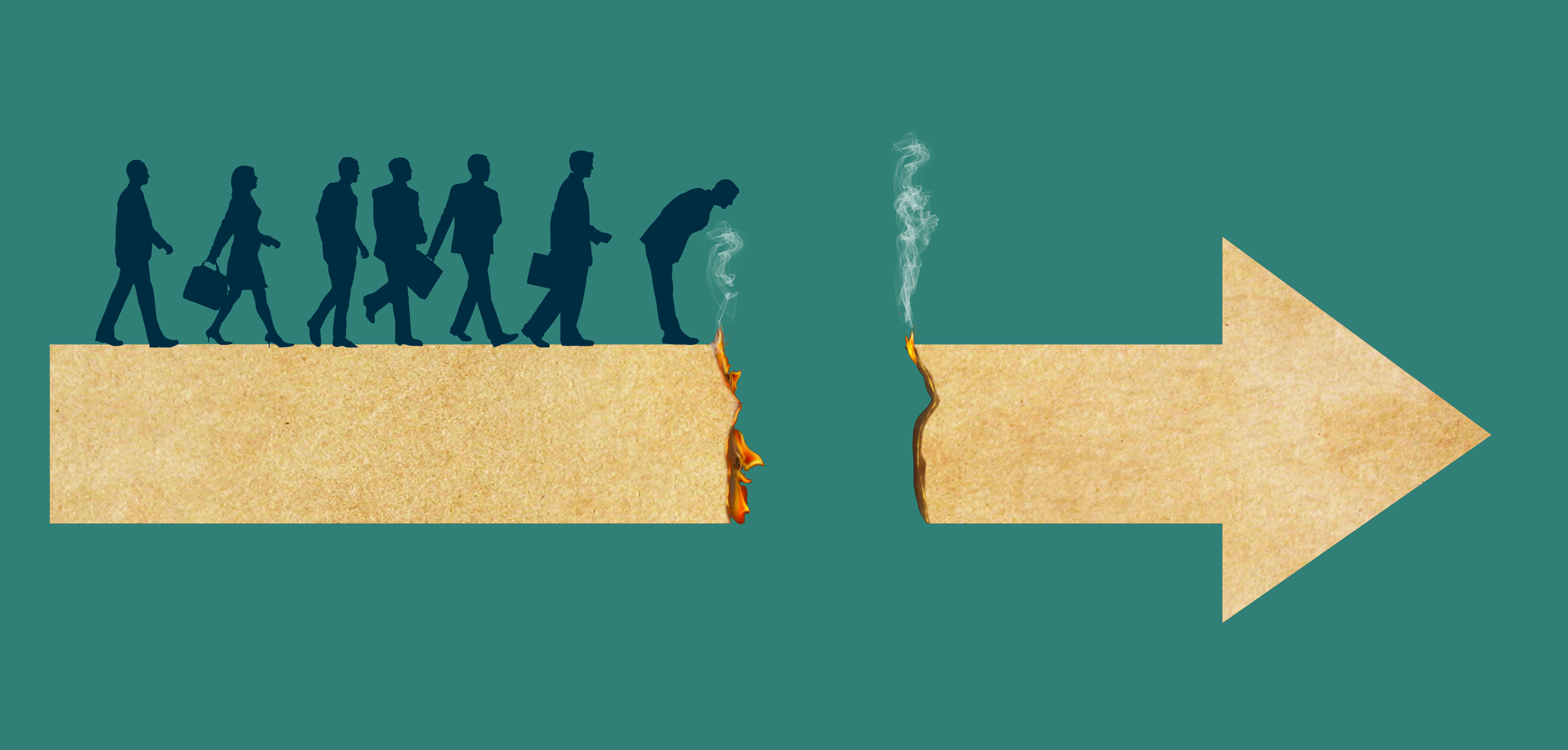

Even the most carefully crafted financial plan will falter if you don’t have the right people to deliver it. Businesses often delay tough resourcing decisions, but this can slow growth or leave you unprepared when opportunities arise.

Proactive resource planning ensures that you’re not scrambling to fill roles under pressure. It’s about aligning people strategy with financial strategy making sure your team structure evolves as the business does. When budgets and resourcing work hand in hand, growth can be pursued with confidence

Cash Flow: Avoiding the “Who Do I Pay Today?” Crisis

Few situations are more stressful for a business owner than a cash flow crunch. One client, Brian, found himself asking daily: “Who do I pay today?” despite hitting revenue milestones. Rapid expansion, competitive pressures, and slower customer payments combined to push the business into crisis.

Short-term fixes included building a simple weekly cash flow model, renegotiating with suppliers, tightening customer terms, and cutting discretionary spend. But the longer-term strategies made the difference: securing working capital facilities early, embedding robust budgeting processes, and building strong supplier partnerships.

The lesson? Cash flow resilience isn’t luck, it’s the result of forward planning and continuous monitoring.

The Common Thread: Ownership and Planning

Whether it’s budgeting, resourcing, or cash flow, the common theme is ownership.

• Budgets must be shared beyond finance teams, with leaders across the organisation accountable for their lines.

• Resourcing must be proactive, ensuring the right people are in place before growth demands it.

• Cash flow must be stress-tested, managed, and planned not left until crisis strikes.

At Strategic Specialists, we believe business success is rarely the outcome of a single big win. It’s built from disciplined decisions delegating responsibility, aligning resources, and keeping a vigilant eye on cash. With these pillars in place, businesses can not only weather uncertainty but thrive through it.

Curious where your business could grow? Book a 30-minute no-obligation strategy chat with us.